I learned this lesson early and the hard way: making money is important, but keeping money is everything. Many people enter finance, trading, or investing with excitement, only to lose confidence—and capital—because they ignored one core principle: risk management.

If you understand this one concept deeply, you will automatically become more disciplined, calmer, and smarter with money.

What is risk management in finance? Learn simple ways to control losses, protect capital, and manage risks.

What Is Risk Management in Finance?

Risk management in finance is the process of identifying, controlling, and limiting potential losses before they happen.

In simple terms, risk management answers one question:

How much am I willing to lose if things go wrong?

Whether you are investing, trading, or running a business, risk is always present. Risk management does not remove risk. It controls it.

Why Risk Management Is More Important Than Profit

Most beginners focus on profits. Professionals focus on survival.

Here’s the truth:

- Profits are unpredictable

- Losses are guaranteed

- Survival creates opportunity

Without risk management:

- One bad decision can wipe out months of effort

- Emotions take over logic

- Consistency becomes impossible

With proper risk management, even average strategies can succeed.

Risk Management in Everyday Finance

Risk management is not limited to trading.

Examples:

- Buying insurance to reduce future loss

- Keeping emergency funds

- Diversifying income sources

- Avoiding unnecessary debt

You already practice risk management in life—finance is no different.

Types of Financial Risk

Understanding risk types helps control them.

Market Risk

Risk caused by price movement in markets.

Credit Risk

Risk of someone failing to repay money.

Liquidity Risk

Risk of not being able to exit an investment easily.

Emotional Risk

Risk caused by fear, greed, or impatience.

Most losses come from emotional risk, not market risk.

Core Principles of Risk Management

1. Capital Preservation First

Your first goal is not to grow money, but to protect it.

2. Define Risk Before Entry

Never enter a trade or investment without knowing:

- Maximum loss

- Exit point

3. Risk Small, Win Big

Risk less on each decision so you can stay longer in the game.

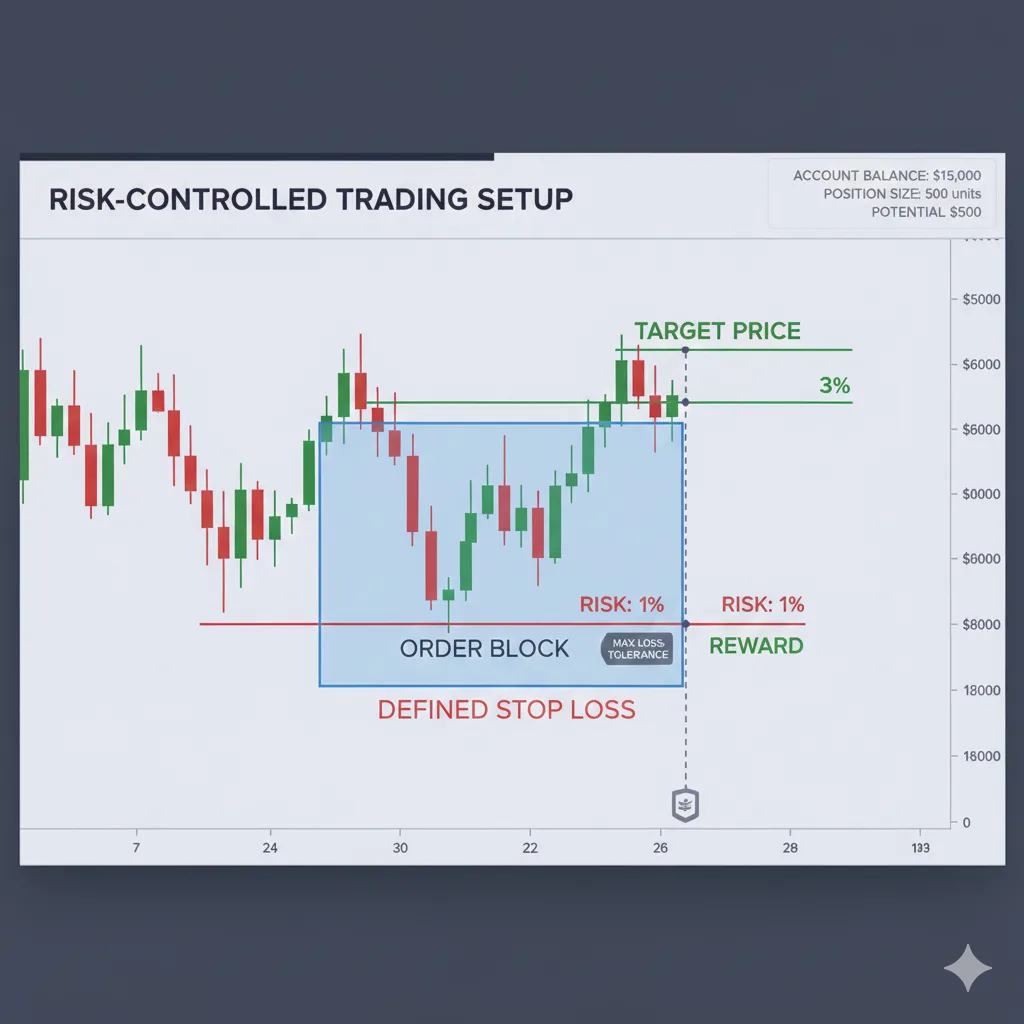

Position Sizing: The Backbone of Risk Management

Position sizing decides how much money you put into a single trade or investment.

A common rule:

- Risk only 1–2% of capital per trade

This allows you to make mistakes without destroying your account.

Stop Loss: Your Safety Net

A stop loss is a predefined exit that limits damage.

Using a stop loss:

- Removes emotional decision-making

- Protects capital automatically

- Creates discipline

Avoiding stop loss is a beginner’s biggest mistake.

Risk Management in Trading

In trading, risk management decides long-term success.

Rules include:

- Fixed risk per trade

- Maximum daily loss limit

- Limited number of trades

Even professional traders lose trades. They just lose small.

Risk Management and OB (Order Block)

When trading OB Order Block, risk management becomes clearer.

Order blocks help:

- Define logical stop placement

- Identify high-probability zones

- Avoid chasing price

Risk is calculated before entering the OB zone.

Risk Management and Liquidity Concepts

Liquidity sweeps and stop hunts exist because traders place obvious stops.

Smart risk management:

- Avoids obvious stop placements

- Uses structure-based exits

Understanding market behaviour improves protection.

Emotional Discipline: The Hidden Risk

Emotional decisions destroy good plans.

Common emotional risks:

- Revenge trading

- Overconfidence after wins

- Panic after losses

Risk management protects you from your own emotions.

Beginner Mistakes in Risk Management

- Risking too much per trade

- No stop loss

- Increasing size after losses

- Trading without a plan

Avoiding these mistakes improves results instantly.

How Beginners Should Build Risk Management Habits

Start with:

- Fixed percentage risk

- One market focus

- Written rules

- Trading journal

Habits beat motivation.

Risk Management in Long-Term Investing

Even investors need risk control.

Techniques include:

- Diversification

- Asset allocation

- Periodic review

Risk management keeps portfolios stable.

Risk vs Reward: The Balance

Risk management is not about avoiding risk completely.

It is about:

- Taking calculated risks

- Avoiding unnecessary risks

Smart money survives first, grows later.

Final Thoughts

Risk management is the foundation of all financial success.

Once you master risk management, fear reduces, discipline increases, and decision-making becomes calm.

Protect capital. Respect risk. Stay consistent.

Frequently Asked Questions (FAQs)

Is risk management necessary for beginners?

Yes. Beginners need it more than professionals.

Can risk management guarantee profits?

No. It guarantees survival, not profits.

What is the safest risk percentage?

Most traders use 1–2% per trade.

Does risk management apply outside trading?

Yes. It applies to all financial decisions.

1 thought on “Risk Management in Finance How to Protect Money”