I remember the first time price suddenly spiked above a clear high, took out my stop loss, and then reversed perfectly in the opposite direction. At that moment, it felt unfair. Later, I realised it was not random at all. It was a liquidity sweep.

If you trade or study markets, understanding liquidity sweep is a game‑changer. It explains why price often moves against the crowd before making the real move. In this guide, I’ll explain what a liquidity sweep is from the basics to an intermediate level, using simple language and real logic—no hype, no confusion.

What is a liquidity sweep? Learn how markets hunt stops, why price reverses, and how traders use liquidity sweeps smartly.

What Is Liquidity Sweep?

A liquidity sweep happens when price moves deliberately toward an area where many stop losses or pending orders are placed, triggers them, and then reverses direction.

In simple words, the market first collects liquidity before making its real move.

Liquidity usually exists around:

- Equal highs

- Equal lows

- Obvious support and resistance

- Trendline breaks

These areas attract retail traders. Institutions use them to fill large orders.

Why Liquidity Sweep Happens in Markets

Big players cannot enter trades the way small traders do. Their order size is huge. They need liquidity.

Liquidity sweeps happen because:

- Institutions need stop-loss orders to enter

- Retail traders place stops at obvious levels

- Price must move into liquidity zones

Therefore, liquidity sweep is not manipulation—it is execution logic.

Liquidity Sweep in Simple Share Market Terms

In the share market, liquidity sweep means:

- Price breaks above recent highs

- Retail traders buy the breakout

- Stops of sellers get hit

- Institutions sell into that buying pressure

Then price reverses.

Once you see this pattern, charts stop feeling random.

Liquidity Sweep vs Breakout

This is where most beginners get trapped.

- Breakout: Price closes and continues with strength

- Liquidity sweep: Price breaks briefly and rejects quickly

The difference is confirmation.

Liquidity sweeps usually show:

- Long wicks

- Fast rejection

- Volume spike

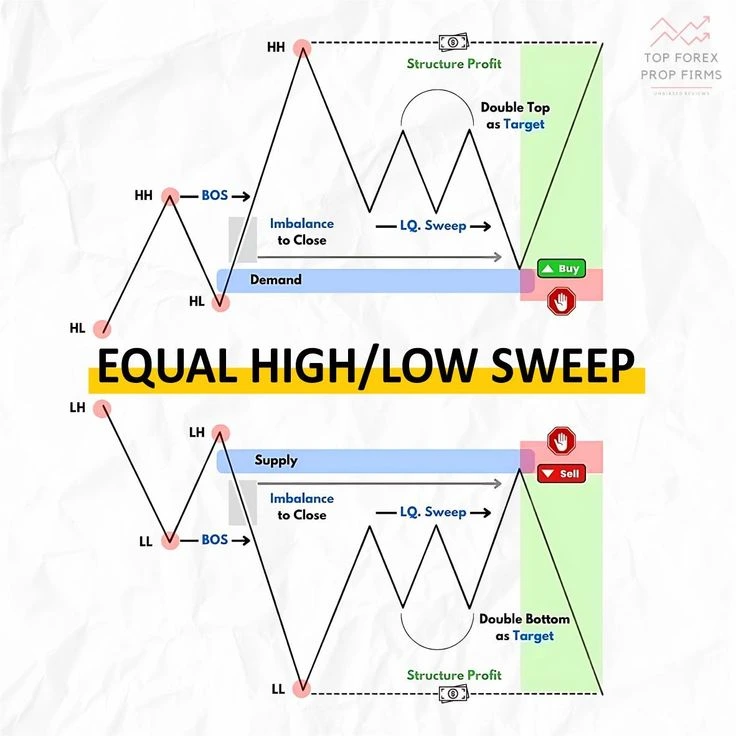

Types of Liquidity Sweeps

Buy-Side Liquidity Sweep

This happens above highs.

Price sweeps buy-side liquidity by taking:

- Buy stop losses

- Breakout buy orders

Then price often moves down.

Sell-Side Liquidity Sweep

This happens below lows.

Price sweeps sell-side liquidity by triggering:

- Sell stop losses

- Panic selling

Then price often moves up.

Liquidity Sweep and Market Structure

Liquidity sweeps work best when aligned with structure.

- In uptrends: look for sell-side liquidity sweeps

- In downtrends: look for buy-side liquidity sweeps

Trading against structure increases risk.

Liquidity Sweep and OB (Order Block)

Liquidity sweeps and OB Order Block work together.

Often, price:

- Sweeps liquidity

- Enters an order block

- Reverses with strength

Order blocks provide the zone. Liquidity sweep provides the reason.

How to Identify a Valid Liquidity Sweep

A valid liquidity sweep usually has:

- Clear equal highs or lows

- Sudden spike into that area

- Strong rejection candle

- Confluence with structure or OB

If price slowly drifts, it’s not a sweep.

Beginner Mistakes With Liquidity Sweep

Common errors include:

- Trading every wick

- Ignoring higher timeframes

- Entering without confirmation

- Over-leveraging

Liquidity sweep is a concept, not a signal.

How Beginners Should Trade Liquidity Sweeps

Keep it simple:

- Mark liquidity levels

- Wait for sweep

- Look for confirmation

- Use tight risk

Patience is your edge.

Liquidity Sweep and Emotional Trading

Liquidity sweeps trigger emotions.

They cause:

- Fear when stops are hit

- Greed during fake breakouts

Understanding liquidity sweep reduces emotional trading because you expect these moves.

To properly understand this concept you also need to understand Trading Psychology.

Liquidity Sweep vs Indicators

Indicators lag price.

Liquidity sweep explains why price moved.

Price always speaks first.

Liquidity Sweep Across Markets

Liquidity sweep works in:

- Stocks

- Forex

- Crypto

- Indices

Wherever liquidity exists, sweeps occur.

Risk Management With Liquidity Sweeps

Always remember:

- Risk fixed percentage

- Place stops beyond structure

- Avoid news events

No setup works without discipline.

Liquidity Sweep in Real Trading Psychology

Once I understood liquidity sweep, I stopped blaming the market.

Instead, I waited.

This shift—from reaction to preparation—is powerful.

Final Thoughts

Liquidity sweep is not about tricking traders. It is about how large money operates.

When you understand liquidity sweep, you stop chasing price and start reading intent.

Stay patient. Stay structured. Protect capital.

Frequently Asked Questions (FAQs)

Is liquidity sweep manipulation?

No. It is a natural part of market execution.

Do liquidity sweeps work for beginners?

Yes, when combined with structure and confirmation.

Is liquidity sweep better than indicators?

It explains price behaviour rather than calculating it.

Can liquidity sweep be used in long-term trading?

Yes, especially on higher timeframes.

1 thought on “Liquidity Sweep in Trading Simple and Clear Guide”