The first time I heard about smart money concepts, I realised something uncomfortable. The market was not random. It was not chaotic. And it was definitely not fair in the way beginners imagine it to be.

Smart money concepts (SMC) explain how institutions, banks, and large players move the market, and how retail traders usually react after the move has already happened. Once you understand this, charts stop looking confusing. Price action starts making sense.

Smart money concepts explained simply. Learn how institutions trade, how price moves, and how SMC helps traders avoid emotional trading mistakes.

What Are Smart Money Concepts?

Smart money concepts refer to a way of analysing markets by tracking the behaviour of large institutional players. These include banks, hedge funds, mutual funds, and professional traders who move large volumes of capital.

Unlike retail traders, smart money does not chase price. It creates liquidity, enters quietly, and exits strategically. Retail traders usually enter late, driven by emotions like fear and greed. SMC helps you identify where this imbalance happens.

In simple terms:

- Smart money = institutions and professionals

- Retail money = emotional, late entries

Understanding this difference is the foundation of SMC.

Why Smart Money Concepts Matter in 2026

Markets have evolved. Algorithms are faster. Liquidity is fragmented. Yet human psychology has not changed.

Smart money concepts matter because:

- Institutions still need liquidity

- Stop losses are still hunted

- Retail traders still chase breakouts

- Price still moves from liquidity to liquidity

SMC does not try to predict markets. It reads intention.

Smart Money vs Retail Trading Mindset

Retail trading focuses on indicators, signals, and confirmation.

Smart money focuses on:

- Where liquidity sits

- Where orders are likely placed

- Where retail traders are trapped

Retail traders react. Smart money plans.

This shift in thinking is what separates consistent traders from frustrated ones.

Core Building Blocks of Smart Money Concepts

Market Structure

Market structure explains whether price is trending or ranging.

- Higher highs and higher lows = bullish structure

- Lower lows and lower highs = bearish structure

Smart money aligns with structure. Fighting structure is costly.

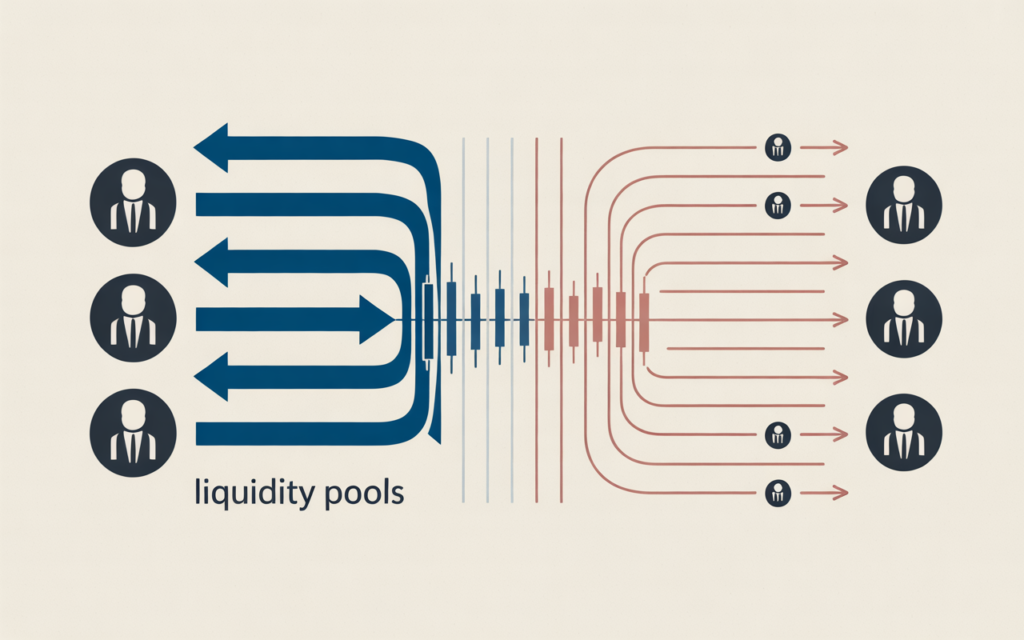

Liquidity

Liquidity is where orders exist. Equal highs, equal lows, trendline breakouts, and obvious support/resistance zones all attract liquidity.

Smart money moves price towards liquidity to fill large orders.

This is why price often spikes before reversing.

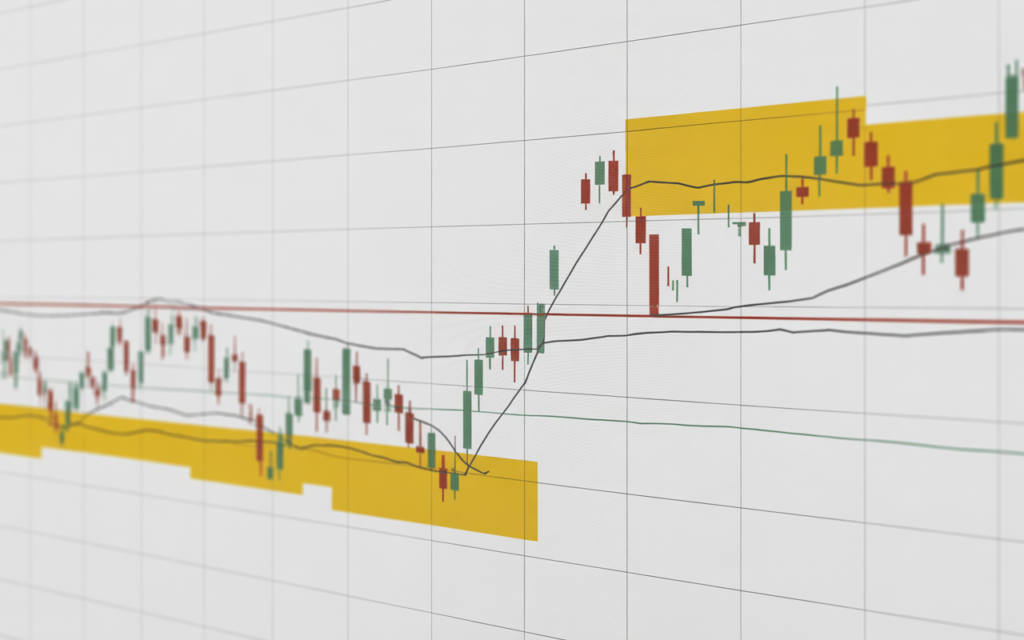

Order Blocks

Order blocks represent areas where institutions placed large buy or sell orders.

They often appear as the last bullish candle before a strong bearish move, or vice versa.

These zones act as high-probability reaction areas.

Fair Value Gaps (FVG)

Fair value gaps occur when price moves aggressively, leaving inefficiency behind.

Markets tend to revisit these gaps to rebalance price.

FVGs are common entry zones in smart money trading.

Break of Structure (BOS) and Change of Character (CHoCH)

A break of structure confirms trend continuation.

A change of character signals potential trend reversal.

These concepts help traders avoid entering against smart money direction.

Smart Money Concepts in Real Trading

Smart money concepts work across:

- Stocks

- Forex

- Crypto

- Indices

The logic remains the same because institutions dominate all liquid markets.

SMC traders wait. They do not chase. They enter where risk is defined and reward is asymmetric.

Smart Money Concepts and Emotional Trading

SMC reduces emotional trading because:

- Entries are planned

- Risk is predefined

- Stops are logical

- Patience replaces impulse

Instead of reacting to candles, you wait for price to come to you. Understanding Trading Psychology is essential, because smart money concepts reduce emotional trading only when mindset is controlled.

Beginner Mistakes While Learning SMC

- Overcomplicating charts

- Marking too many zones

- Ignoring higher timeframes

- Expecting instant results

SMC is a skill. It rewards patience, not urgency.

How Beginners Should Learn Smart Money Concepts

- Start with market structure

- Understand liquidity

- Learn basic order blocks

- Practice on higher timeframes

- Journal every trade

Progress slowly. Consistency matters more than speed.

trading for beginners from zero to smart money moves

Smart Money Concepts vs Indicators

Indicators lag price.

Smart money concepts read price itself.

Indicators can assist, but price tells the truth first.

Applying Smart Money Concepts in General Finance

SMC logic applies beyond trading.

In investing and finance:

- Institutions accumulate quietly

- News distributes to retail

- Price moves before headlines

Understanding this improves decision-making in long-term investing as well.

Risk Management Within Smart Money Trading

No concept works without risk control.

Use:

- Fixed risk per trade

- Logical stop placement

- Fewer but better trades

Smart money protects capital first.

Final Thoughts

Smart money concepts are not a shortcut. They are a lens.

Once you see how institutions operate, markets feel calmer. You stop chasing. You start waiting.

Master structure. Respect liquidity. Control emotions.

Frequently Asked Questions (FAQs)

Are smart money concepts suitable for beginners?

Yes. When learned step by step, SMC helps beginners avoid emotional trading.

Do smart money concepts work in all markets?

Yes. Any market with liquidity follows similar institutional behaviour.

Are smart money concepts better than indicators?

They are different. SMC focuses on price behaviour, not calculations.

How long does it take to learn SMC?

Several months of focused practice and chart time.

1 thought on “Smart Money Concepts (SMC) How Big Players Really Trade”